The semiconductor industry is at the heart of modern technology, powering everything from smartphones to self-driving cars. As global demand for computer chips continues to soar, major players like Intel, Samsung, and TSMC are racing to expand their chip development and manufacturing capabilities in the United States. However, this ambitious drive to bolster domestic production faces a significant obstacle: a severe shortage of skilled workers.

“The competition for talent is fierce,” acknowledges Cindi Harper, Vice President of Human Resources, Talent Planning, and Acquisition at Intel. “It’s a candidate’s market, meaning the demand for talent far exceeds the current supply.”

Mark Granahan, CEO of Perfect Semiconductor, a five-year-old chip startup in Allentown, Pennsylvania, concurs, stating, “There’s a shortage of semiconductors and people to make them. It’s not limited to a specific skill set or role; it’s a broad challenge across the board.”

This skills gap is exacerbating an existing chip supply shortage, a problem that existed before disruptions caused by the COVID-19 pandemic. Older semiconductor fabrication plants were already running at maximum capacity, as noted by Alan Priestley, a Vice President Analyst at Gartner Research. The pandemic further complicated the situation, as it disrupted demand forecasts and supply chains.

Major tech companies such as Apple, Microsoft, Alphabet, Amazon, and others have been urging the U.S. government to boost domestic chip manufacturing. The shortage has become so severe that at one point in 2021, there was only a five-day global supply of chips, with no signs of immediate improvement, according to a U.S. Commerce Department report from January.

Gina Raimondo, the U.S. Commerce Secretary, expressed concern about the situation, saying that automakers and other chip users have “no room for error.” Urgent action is needed to expand domestic capacity.

The Demand for Skilled Talent

Building new chip manufacturing facilities is a critical step, but it requires a skilled workforce. However, recruiting and retaining these skilled workers has proven challenging. For example, Granahan shared that it took a year to find a Ph.D.-level engineer and an additional nine months to secure a visa to bring the engineer from Europe to the U.S.

Granahan argues that the United States could benefit greatly from an aggressive legislative agenda aimed at attracting more skilled STEM (science, technology, engineering, and math) professionals. He believes that this challenge isn’t unique to his company; tech giants like Intel, Apple, Microsoft, and Qualcomm are likely facing similar hurdles.

According to the U.S. Bureau of Labor Statistics, STEM job openings are expected to grow by 11% from 2020 to 2030. However, China has already surpassed the United States in the number of advanced STEM degrees its students earn annually. To remain competitive, the U.S. must improve workforce training and enact reforms that facilitate high-skilled immigration, according to the Institute for Progress, a Washington-based research and STEM education advocacy organization.

Jeremy Neufeld, a Senior Immigration Fellow at the Institute for Progress, highlights the need for policy changes, such as exempting international graduates with advanced STEM degrees from restrictive caps. He explains that “75% of STEM Ph.D.s in the U.S. semiconductor manufacturing industry are born overseas,” emphasizing the urgent need to address the talent shortage.

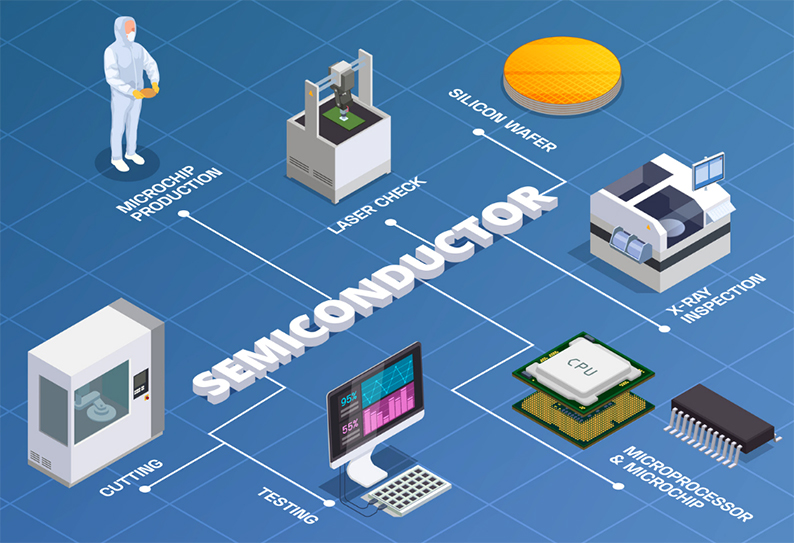

The Challenge of Semiconductor Manufacturing

While technology bootcamps and accelerated computer science degree programs are expanding to meet industry demand, many positions at semiconductor fabrication plants require highly specialized skills. Granahan points out that while hiring recent graduates is an option, it is insufficient given the breadth and depth of expertise needed in a startup environment. “We need more two-year degrees, master’s degrees, and Ph.D.s. Specialization is crucial, but a diverse skill set is also essential,” he asserts.

The Decline in U.S. Chip Manufacturing Share

The United States’ share of global semiconductor manufacturing capacity has steadily declined over the years, according to the Congressional Research Service (CRS). In 1990, the U.S. accounted for about 40% of the semiconductor market, which dropped to approximately 12% by 2020.

While the U.S. is not at the bottom in terms of global chip production, the decline continues. Currently, nearly 80% of global chip fabrication takes place in East Asia. Companies like Google, Apple, and Amazon heavily rely on East Asian chip manufacturers, creating a dependency on foreign sources.

Upskilling and Reskilling as a Solution

One potential solution to address the talent shortage and boost domestic chip production is upskilling and reskilling the workforce. A report by eightfold.ai, a tech talent management software vendor, suggests that by focusing on adjacent skills and providing training opportunities, the U.S. can expand its pool of semiconductor talent. Government policy changes, such as tax credits and investments, can support the reshoring of semiconductor manufacturing, which is essential to address current bottlenecks.

Despite bipartisan support for legislation like the CHIPS Act and the US Innovation and Competition Act (USICA), which provide incentives and funding for semiconductor manufacturing, congressional negotiations have yet to reach a consensus on funding. These legislative efforts aim to create a more favorable environment for chip manufacturing in the U.S.

Intel, among other companies, has been actively advocating for the CHIPS Act, emphasizing the importance of government support to level the playing field for U.S. chipmakers. “This partnership from the public sector is needed to compete with international competitors who benefit from significant government subsidies,” Harper emphasizes.

Investing in the Future of Chip Manufacturing

Intel has invested approximately $20 billion in constructing two new chip factories in Ohio to meet the surging demand for semiconductors. Additionally, other manufacturers like Samsung, Texas Instruments, and GlobalFoundries plan to build or expand their semiconductor production facilities in the U.S. over the next few years.

To address the talent shortage, Intel is collaborating with universities and community colleges and plans to invest around $100 million over the next decade in new STEM programs. The U.S. National Science Foundation will also contribute an additional $50 million for nationwide initiatives.

“This totals $150 million dedicated to semiconductor manufacturing education and research,” Harper explains. “We are committed to nurturing STEM talent, starting with early education through secondary education, as it is the most effective long-term strategy to address labor challenges.”

In conclusion, while the semiconductor industry faces a significant talent shortage and challenges in reshoring production, investment in upskilling, reskilling, and government support for legislative initiatives are essential steps to ensure that the United States remains a competitive player in the global chip manufacturing landscape. Closing the skills gap is not only vital for the industry’s growth but also for maintaining technological leadership on the world stage.